If you are like most Americans, a majority of your income and assets are based on U.S. dollars. As you know, that puts you at risk of losing your purchasing power as America struggles with inflation, market volatility, economic uncertainly, and, most importantly, its multi-trillion-dollar debt level. That is where a gold and silver IRA can help. If you’re comparing gold and silver IRA accounts, here is how they protect purchasing power and strengthen retirement security.

- Use the IRS rules that allow you to hold gold and silver bullion inside a tax-advantaged account.

- Follow the same approach that family offices and trusts use to protect wealth from currency devaluation and taxes.

- Most important of all, choose a top-rated provider so your account is set up correctly and your benefits remain intact.

Our picks for the best precious metals IRA accounts in 2025 can help you establish a compliant bullion-based IRA quickly and clearly.

As a result, you get peace of mind knowing your savings are structured to maximize tax advantages when it matters most.

Why a Gold and Silver IRA Belongs in Your Portfolio

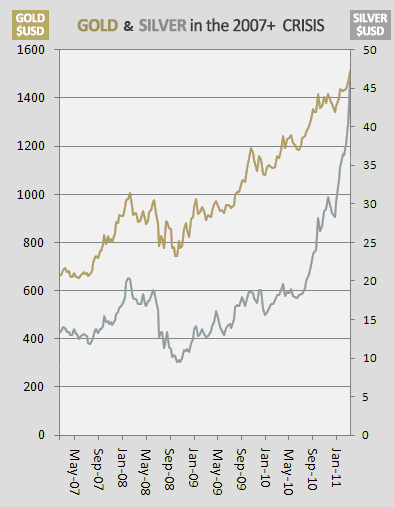

There are several compelling reasons for opening a gold and silver IRA rather than keeping your retirement savings fully exposed to the dollar. First, gold and silver tend to preserve purchasing power during inflationary cycles. Additionally, they diversify risk away from stocks, bonds, and cash. Finally, holding physical bullion inside a self-directed IRA allows tax-deferred growth while adding a proven safe haven during market stress.

Added Benefits for Retirement Metals Investing

Beyond diversification, retirement metals investing can improve liquidity planning. For example, coins offer flexible sale sizes for future required minimum distributions. Meanwhile, bars can reduce premiums for long-term holders.

Is It Legal to Hold Gold and Silver IRA Accounts?

Yes—U.S. law allows Americans to hold IRS-approved gold and silver inside self-directed IRAs. Unlike collectibles or jewelry, eligible assets meet specific purity standards. Furthermore, metals must remain in an approved depository rather than at home. These rules promote consistent quality and proper tax treatment.

What the IRS Approves

- Gold: 99.5% purity (minimum) in approved coins and bars.

- Silver: 99.9% purity (minimum) in approved coins and bars.

- Storage: an IRA-approved custodian and qualified depository are required.

Best Gold and Silver IRA Accounts in 2025: Our Top Picks

#1 Best Overall: Goldco

If you’re looking to help preserve your wealth in today's uncertain financial landscape, Goldco offers significant experience and a full-service approach. Goldco's precious metal accounts let you hedge your future against economic and political instability. As a solid company with a record of strong customer satisfaction, Goldco is ideally positioned to help you create a secure retirement.

Did you know that precious metal IRAs may only include bullion bars and coins from an IRA approved selection? The investments must be COMEX/NYMEX accredited. That is an-investor friendly regulation since the bullion must be sufficiently pure to meet these requirements.

With silver, the products must be 0.999 pure to be deemed suitable for precious metal IRAs. Bullion coins are valued on their precious metal content only. Collectible, numismatic, and slabbed/graded coins are not permitted in an IRA (with the exception of American proof gold and proof silver Eagles). The IRS also requires that your metals are held with an IRA-approved custodian.

Of course, when you open your gold and silver IRA account with one of our top-rated precious metals IRA Companies such as Goldco, these details are taken care of for you.

Click to Download the Best Overall Choice Now

At Goldco, your Silver-Backed IRA holdings will be stored in an insured and licensed depository. And your account will be managed by an approved custodian.

This provides you with maximum peace of mind that your retirement account is backed by the rigorous requirements defined by the IRS.

Goldco is an industry leader, built on unwavering ethics and a continuing commitment to a positive customer experience. Additionally, the company is recognized for its efforts to educate customers about the value of Silver-Backed IRAs in today’s economic environment.

Goldco’s professional approach makes them easy to deal with. After learning about your goals and answering all of your questions, Goldco advisors will walk you step-by-step through the entire investment process. This thorough approach helps ensure proper compliance, so you’ll lock in all the tax-saving benefits of this unique investment strategy.

Goldco works with all the leading Self-Directed IRA custodians and will help you select the best one for your needs. They will also arrange secure vaulting with leading precious metals depositories. Throughout the process, Goldco is with you every step of the way.

Goldco Gold and Silver IRA Review of Fees and Costs

Goldco Gold and Silver IRA Review of Fees and Costs

Goldco offers both a silver Self-directed IRA option and a Non-IRA cash purchase. Here is our summary of their fees and costs.

(Please note that fee information is current as of this review.)

Minimum Purchase Requirements:

Custodian Fees:

The following fees are charged by the custodian that manages your account, not Goldco.

Setup Fees:

Annual Fees:

Storage/Insurance: $100 non-segregated storage. Add $50 for segregated storage

Early Bird Bonus: Get up to 10% in FREE* Silver

Here’s a special offer that can help you further protect your retirement in dangerous times. By acting fast, you can qualify for up to 10% in BONUS silver when you open and fund a Silver-backed IRA.

Goldco is offering up to 10% in FREE Silver when you open your new Silver-backed IRA account to help get you started on your precious metals journey. (As a limited-time offer, please contact Goldco for details on availability and how to qualify.)

Example:

- Open a Silver IRA with $100,000 and Goldco will award you $10,000 in FREE SILVER.

Send It Anywhere ✓

It’s your choice! Elect to have your FREE bonus Silver sent to your home with FREE SHIPPING or arrange to have it deposited directly into your new Silver-Backed IRA.

How To Claim: To take advantage of this offer, just mention the 10% FREE Silver Promotion to your Goldco Representative. They will explain the offer when they contact you to arrange shipping of your free Silver IRA kit.

*Applies only to qualified orders. Get up to 5% back in FREE Silver when you purchase $50,000 – $99,999. Get up to 10% in FREE Silver when you purchase $100,000 or more. Cannot be combined with any other offer. Additional rules may apply. Contact your representative to find out if your order qualifies. For additional details, please see your customer agreement. Goldco does not offer financial or tax advice.

Goldco Silver IRA Reviews

![]()

“I have made three purchases of gold and silver from Goldco. They have always been very professional, organized and extremely helpful. I highly recommend you contact them if you are interested in learning more about how to purchase gold and silver coins.”

Tim M.

![]()

![]()

“Converted my 401K stock to a silver coin 401K in precious metals. The process was easy and painless and my broker along with all the other people I worked with was really GREAT! Thanks Goldco. I will recommend you to everyone I know.”

Kenneth R.

![]()

![]()

“Goldco has been wonderful to work with as our first experience in purchasing precious metals. Every step explained and great customer service in answering all our questions. We are very pleased to be new customers.”

Anita D.

![]()

Our #1 choice for 2025 is Augusta Precious Metals, established in 2012. What we like most about Augusta is its stellar record on customer service. After scouring the major third-party consumer protection websites, we found zero customer complaints. You read that right, not just a small percentage; actually zero complaints, as of the date of this review.

This record of prioritizing the customer experience has led us to rank Augusta Precious Metals at the top of our list of the best silver IRA providers. If you’re looking to diversify your savings safely and securely into silver or gold, you can’t go wrong with Augusta, in our opinion.

An Augusta Precious Metals Silver IRA will help you diversify your retirement portfolio and help counter the impact of inflation. In addition, you will be positioned to profit from increased silver demand for use in solar panels, electric vehicles, and the growth of 5G networks.

As one of the pioneers in the Silver IRA space, Augusta has a long track record of award-winning customer service.

They also prioritize education. They are perhaps best known for providing a thorough and acclaimed web conference that provides an overview of precious metals investing. Going the extra mile in these ways is what earns Augusta our top ranking.

The company also holds memberships in several professional associations, further evidencing their commitment to fair dealings with their customers, suppliers and the community at large.

With the Federal Reserve’s continued money printing, combined now with increasing inflation, it’s more important than ever to secure your retirement savings. Augusta Precious Metals is an ideal partner to help you navigate the current and future complex economic landscape.

Working with Augusta Precious Metals could not be easier. To get started, simply visit their website where you can request a free guide to precious metals investing, or sign up for their free educational web conference.

Once you sign up, an Augusta Precious Metals specialist will be available to you to answer any questions you have about establishing a Silver IRA account.

Augusta Gold and Silver IRA Review of Fees and Costs

Augusta Gold and Silver IRA Review of Fees and Costs

With Augusta Precious Metals, you can either make a cash purchase or setup your account as a Self-directed Silver IRA. Here is our review of their fees and costs.

(Please note that fee information is current as of this review.)

Custodian Fees

Augusta uses Equity Trust as their preferred Silver IRA custodian. For this custodial service, there is a one-time set up fee of $230, plus a recurring annual fee of $180. The fee is the same regardless of account size.

If you prefer, other custodian services are available, including GoldStar Trust Company and Kingdom Trust. Please contact Augusta Precious Metals directly if you wish to discuss the use of an alternate custodian. Please note these other custodians may have differing fee schedules. Augusta can provide that information to you upon request.

Shipping Costs

Augusta Precious Metals offers free shipping for orders over $100,000.

Storage Information

Your silver purchases are stored with the Delaware Depository. This independent, private company is a secure non-governmental storage facility. The customer assets they safeguard are inaccessible and protected from the facility’s creditors. The facility is ideally located a significant distance from financial and political centers.

Minimum Investment

Minimum investment required is $50,000. This minimum applies to both an IRA and a cash purchase. The minimum may be satisfied through the purchase of any combination of metals (gold, silver, etc.) There is no maximum order size or other limitation.

Current Augusta Precious Metals Promotions:

- Complimentary Shipping for Orders Over $100,000

- Free Storage Up to 5 Years

- Volume Discounts are Available

How To Claim: When you speak to an Augusta Precious Metals Specialist, just mention these promotions when they call to customize your free information kit.

Augusta Silver IRA Reviews

#3 Established, Reliable Provider: GoldenCrest Metals, LLC

GoldenCrest Metals, LLC ranks among our top Silver IRA companies. Their specialists bring extensive experience managing bullion, coins, and ingots, ensuring every client’s transaction flows smoothly.

Whether you’re rolling over an existing IRA or funding a new Silver IRA, GoldenCrest Metals streamlines the transfer of physical precious metals into retirement accounts. Thousands of investors have diversified their portfolios with the firm’s guided approach.

For those seeking a trusted partner in setting up a silver-backed IRA, GoldenCrest Metals, LLC stands out. Their helpful team guides you through every step to maximize your retirement holdings with silver.

Notably, GoldenCrest Metals, LLC offers one of the industry’s lowest IRA minimums at just $10,000.

GoldenCrest Metals, LLC Gold and Silver IRA Review of Fees and Costs

GoldenCrest Metals, LLC Gold and Silver IRA Review of Fees and Costs

GoldenCrest Metals, LLC facilitates both direct cash purchases and self-directed Silver IRAs. Contact them directly to discuss non-IRA orders. Below is our summary of their current fees and costs.

(Fee details accurate as of this review.)

They partner with International Depository Services in Dallas, TX for insured storage.

IRA Annual Account Fee: $80 per year

Storage Fee: $150 per year (rates may vary by depository selection)

All IRA fees include insured shipping.

Minimum Investment:

$3,000 for cash purchases

$10,000 for Silver IRA accounts

Current Promotions:

- First-year IRA fees waived for qualifying new accounts

- $25,000 in free silver available on larger orders

How to Claim: Mention available promotions when contacting GoldenCrest Metals, LLC.

GoldenCrest Metals, LLC Silver IRA Reviews

I had the pleasure of working with GC for my gold investment, and the experience was exceptional. Their team was incredibly knowledgeable, guiding me through the process with patience and professionalism. I felt confident in my investment decisions, and the quality of the precious metals exceeded my expectations. Highly recommended!”

Samantha Williams

Orlando, FL

Choosing GC for my silver investment was a game-changer. Their commitment to transparency and customer satisfaction is commendable. The entire process was seamless, from discussing investment strategies to the secure delivery of my silver. GC truly stands out in the world of precious metals.”

Jake Thompson

Irvine, CA

I can’t thank GC enough for their expert advice and personalized service. As a first-time investor in precious metals, I had many questions, and their team took the time to address each one thoroughly. The result? A diversified portfolio that I feel confident about. Trust GC for a smooth and rewarding investment journey.”

Emily Chen

Boca Raton, FL

#4 Established, Reliable Provider: American Hartford Gold

Founded in 2015, American Hartford Gold is an industry leader in Silver IRA rollovers. Their team specializes in helping you convert an eligible 401(k) or your existing IRA into silver or other precious metal holdings.

One unique thing we like about American Hartford Gold is their focus on education and providing comprehensive information. They’ve pledged to guide and educate investors through the process of setting up a Silver-backed IRA. That can help you better understand everything so you can feel more confident about the result.

This philosophy that educated clients make the best clients is ideal for financial services, where investor confusion is common. Their skilled and well-trained staff will help make the entire experience smooth and seamless for you.

American Hartford Gold is also recognized for its customer service and knowledgeable account executives. With a full-service IRA Department and easy-to-understand pricing, most people find the Silver IRA setup process quite easy.

Everyone at American Hartford Gold is passionate about providing a high level of customer service and making sure you understand every step in the process.

In the final analysis, we rate American Hartford Gold as one of the best Silver IRA companies, with a reputation built on experience and a pro-education philosophy. Their experienced staff have helped thousands of other investors shield their wealth using precious metals. To help learn more about this provider, use the link below to order your complimentary American Hartford Gold Precious Metals Kit.

American Hartford Gold Gold and Silver IRA Review of Fees and Costs

American Hartford Gold Gold and Silver IRA Review of Fees and Costs

American Hartford Gold offers precious metals both for your self-directed IRA as well as direct cash purchases. Please contact them directly regarding non-IRA cash transactions. Here is our review of their fees and costs.

(Please note that fee information is current as of this review.)

American Hartford Gold primarily uses the STRATA Trust Company and the Delaware Depository for storage.

Account setup fee: $50

Annual account fee: $95

Annual storage fee: $100 for comingled storage or $150 for segregated storage. (Please note that segregated storage is available for gold, platinum, and palladium only).

Shipping: $10 + estimated shipping cost

Please note: Minimum investment is $10,000 inside of an IRA.

Current American Hartford Gold Promotions:

- For transactions of $50,000, American Hartford Gold will pay your first year's fees.

- Receive up to $15,000 in Free Silver on Qualifying Purchases.

- Special savings available on selected bullion products – ask for current offers.

How To Claim: Ask about current promotions when your American Hartford Gold Precious Metals Specialist calls to customize your free information kit.

American Hartford Gold Silver IRA Reviews

I couldn't have had a more positive experience working with Advantage Gold. After deciding I wanted to invest in physical gold and silver I reached out to the team at Advantage Gold. Only after I spoke with several other vendors did it become apparent how thorough and informative these firm is. Wow, what a difference! I'm happy to say I will be a long time customer. Many thanks, GW”

Garrett W

Marc Neal and Advantage Gold gave me an education before trying to sell anything. I took at least three years to decide. However, making friends and having a caring attitude are the reasons that I did business with them. Marc gave me research tools and then circled back to give me information that helped me to evaluate my options and what is the best route in today’s market…”

John M.

Michael and his team provided excellent service. Our transfer of funds from our old IRA to Advantage Gold was not the easiest, but Michael and his team took care of us every step of the way. They were in constant contact with our previous financial institution on almost a daily basis to make sure that the funds were being transferred as requested. Once transferred, Michael educated us…”

Dennis

#5 Established, Reliable Provider: Birch Gold Group

As with Goldco and Augusta, Birch Gold gives you another solid choice for your silver investment. A Birch Gold Silver-Backed IRA gives you the ability to invest your tax-advantaged retirement savings directly in precious metals, helping you hedge your wealth and offset the volatility of the stock and/or bond market.

Should you choose Birch Gold as your provider, they offer many IRA-approved gold, silver, platinum, and palladium precious metals products eligible to incorporate into your self-directed IRA account.

Birch Gold offers a COMEX/NYMEX accredited array of precious metal options for your retirement portfolio. Your silver IRA investment options include American Silver Eagle Bullion and Proof Coins, American Gold Eagle Bullion and Proof Coins, American Platinum Eagles, Canadian Gold Maple Leaf Coins, and more.

Birch Gold Group is not the largest of the silver IRA companies we ranked, but they consistently excel in critical areas. As a smaller company, you’ll enjoy a high level of personal service.

Birch Gold is perhaps best known for their Gold IRA and Silver IRA services and free information kits, which can help your decision-making process. Birch Gold is well respected by American investors looking to add silver investment (or other precious metals) both inside and outside their retirement accounts.

One thing we like about Birch Gold: though their team of precious metals specialists are extremely passionate about their beliefs, they are never pushy or aggressive in ways some other silver investment companies can be.

Instead, they put their deep experience and significant market knowledge to work on your behalf, making sure you are satisfied with your silver investment.

Birch Gold and Silver IRA Review of Fees and Costs

Birch Gold and Silver IRA Review of Fees and Costs

With Birch Gold Group, you may purchase a silver investment (or other precious metals) either in a self-directed IRA or as a cash purchase (non-IRA). Here is our review of their fees and costs.

(Please note that fee information is current as of this review.)

Is there a Minimum Investment requirement?

One-Time Fees:

Wire Transfer Fee: $30

Annual Fees:

Storage/Insurance: $100

Please note: For transactions over $50,000, Birch Gold will pay your entire first year of fees. Also, when you setup a Silver-backed IRA with Birch Gold’s primary recommended custodian, you will not be charged a percentage custodial fee. Instead, you will be charged the flat fee of $180 ($80 for the IRA plus $100 for storage and insurance). That fee will not vary no matter the size of your account.

Please contact a Birch Gold Precious Metals Specialist for more details.

Current Birch Gold Group Promotions:

- For transactions over $50,000, Birch Gold will pay your first year’s fees.

- Get up to $10,000 in free precious metals – minimum purchase and other conditions apply.

- Special savings offered on selected bullion products – ask for current offers.

How To Claim: Ask your Birch Gold Precious Metals Specialist about current offers and how to qualify.

Birch Gold Group Silver IRA Reviews

The Birch Gold Group has been a pleasure to work with in obtaining my precious metals for security…the professional attitudes and confidence displayed make Birch Gold Group a ‘GOLD STANDARD'.”

J. Brown

As someone who is exploring options for my IRA, I have to say I wholeheartedly recommend contacting Birch Gold and discussing possibility of rolling over into precious metals…”

Anna C.

I was fortunate to have picked the Birch Gold Group to aid and assist me through my purchase. They answered every question and helped me with which investment would be a proper fit for my situation.”

H. Brown

Types of Precious Metals You Can Hold in a Gold and Silver IRA

Approved products include a wide range of bullion. By combining coins and bars, you can balance liquidity with long-term storage efficiency. In practice, many investors mix both for flexibility.

Gold Bullion (Coins & Bars Approved by the IRS)

- Popular Coins: American Gold Eagles, Canadian Gold Maple Leafs, British Britannias.

- Bullion Bars: From 1 oz to 1 kg; refiners like PAMP Suisse and Valcambi remain widely trusted.

Silver Bullion (Coins & Bars Approved by the IRS)

- Popular Coins: American Silver Eagles, Canadian Silver Maple Leafs, Austrian Philharmonics.

- Bullion Bars: Choose from 10 oz, 100 oz, and kilo-sized bars from COMEX/NYMEX-approved refiners.

How to Choose the Best Gold and Silver IRA Company

Not all providers offer the same service level. To ensure success, weigh the following factors before you commit.

Reputation & Customer Reviews

Check independent platforms like BBB, Trustpilot, and Consumer Affairs. Responsive teams with consistent high ratings usually deliver smoother onboarding and clearer expectations.

Transparent Fees & Storage Options

Leading firms publish setup, custodial, and storage fees upfront. Therefore, you avoid surprises and can compare offers accurately.

Education, Rollover Help & Ongoing Support

Top gold & silver retirement accounts provide step-by-step onboarding checklists, rollover assistance, and plain-English guides. Additionally, webinars and one-on-one support help you make confident decisions.

Laws & Tax Considerations for Gold and Silver IRA Accounts

The IRS framework is generally investor-friendly; however, it requires strict compliance. For example, only approved bullion qualifies, and home storage voids tax benefits. Withdrawals follow standard IRA rules, yet you may either liquidate to cash or take physical delivery at retirement age. With Traditional IRAs, growth is tax-deferred. With Roth IRAs, qualified withdrawals are tax-free.

Compliance Essentials for Precious Metals IRA Accounts

- Use a qualified custodian and a recognized depository.

- Stick to IRS-approved coins and bars; avoid collectibles.

- Keep documentation for transfers, purchases, and storage.

Step-by-Step Guide to Opening a Gold and Silver IRA

- Define Your Goals: Decide whether you want inflation protection, diversification, or legacy planning.

- Select a Company: Compare providers on education, fees, and service quality.

- Open and Fund a Self-Directed IRA: Work with the custodian to set up and fund your account.

- Select Approved Gold and Silver Products: Choose IRS-eligible coins and bars that fit your strategy.

- Arrange Custodial Storage: Your provider coordinates secure depository storage. As a result, holdings remain safe and compliant.

Fast-Track Tips

- Request a written fee schedule before funding.

- Ask for sample trade confirmations and storage statements.

- Confirm rollover timelines to minimize downtime.

Tips to Get the Most from Your Gold and Silver IRA

- Stick to IRA-Approved Products: Avoid collectibles and graded coins.

- Vet the Company: Look for strong reviews and quick response times. Moreover, verify custodian partnerships.

- Check Fees: Compare custodial and storage fees. In contrast, be wary of firms that refuse to publish pricing.

- Stay Educated: Markets change. Therefore, follow economic updates and provider webinars.

FAQs About Gold and Silver IRA Accounts

Can I hold both gold and silver in one IRA?

Yes. A self-directed IRA lets you diversify across gold, silver, platinum, and palladium, provided they meet IRS standards.

What are the minimum investment amounts?

Most top companies require $10,000–$25,000 minimums, though some allow smaller purchases. Cash accounts often carry lower entry points.

Can I take physical possession of my gold and silver?

Yes, but only as a distribution from your IRA. Before retirement age, this creates a taxable event. After retirement, metals can be shipped directly to you.

Conclusion: Protect Your Future with the Best Gold and Silver IRA

Choosing the best gold and silver IRA starts with a clear plan for inflation protection and diversification. A physical bullion IRA combines tax advantages with safe-haven value. By selecting one of the best providers for 2025, you can secure your savings with tangible assets.

Ready to take the next step? Compare the top-rated providers and request your free information kit today.